Growing up, money wasn’t much discussed in the open. It was considered a vulgar topic. Asking someone how much something cost was unthinkable, people who flaunted their wealth, or worse, told you the price of their recent acquisition, was beyond the pale of good taste. Nowadays we openly discuss the cost of living. It’s a good tool for our kids to realize that what they see online isn’t feasible, it’s a fairytale, while the rest of us wait in line at the grocery store wondering how on earth that small basket of stuff cost so much.

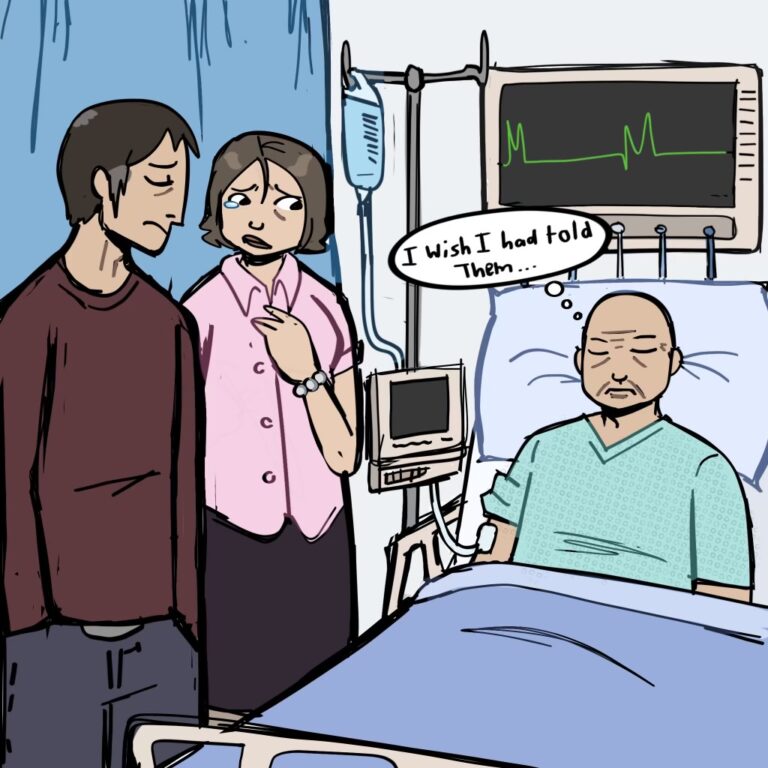

We can all see that the cost of living has risen sharply, while incomes have remained flat. And when you’re on a fixed income, your belt can feel even tighter. It’s kind of scary, isn’t it? Sometimes even asking about financial planning can be daunting, especially for those of us, (us included) who aren’t as financially literate as we may need to be. Sometimes, it just feels better to ignore it, not ask, how much does this cost… But that only compounds the fear of the unknown.

At Discerning Seniors, we remove that fear. We break down the cost of living as your needs change and answer the hard questions so that you can get on with living in comfort. Sound financial planning for the future shouldn’t be a scary bogeyman, nor should it be vulgar to ask. That said, financial language can be tricky. All that jargon? Long letters from financial institutions with graphs- who can make sense of that? Sure you can ask family, but sometimes that can be a little uncomfortable. Let us help connect you with trustworthy experts who can translate it all into easy-to-follow advice. We can help map your journey to help navigate the kind of care you may need, step by step, so that you won’t feel overwhelmed and more importantly, you’ll feel in control.

Here are a couple of examples of people we work with:

“Mary” is 75 years old and needs help with her husband who has had a stroke. She gets 4 hours a week from the government but needs more time for herself. So a Personal Services Worker would suit her situation best; $30/$35/ hour for 10 extra hours a week- total of $350 a week, unless this can be waived.

“Patricia” is 82. She and her husband still live in their own house but find the stairs too much. They wish to move to a bungalow. They will need to declutter- 10 hours at $375= $3750; Sale of house purchase 6% of value of home; Painting, staging ($10,000- $15,000). Cost in total to move: $18,750, plus land transfer tax and a municipal one in some cities. A bungalow would allow Patricia to still enjoy her garden without the worry of stairs.

Some clients prefer to move into a retirement home. These, mostly private, apartments allow our clients to have meals cooked of them, some nursing attention, and full housekeeping. Additionally, more social activities mean that they can keep up their hobbies, meet new friends or simply dip in and out of a social activity as they wish. This usually starts at $4,500 a month.

Getting older shouldn’t be scary. Your options can vary and may pleasantly surprise you. Discerning Seniors can offer you peace of mind to enjoy the money you worked hard to save to ensure a comfortable future, preserve your autonomy and ensure your journey is a wonderful one.