…and US Companies are buying Canadian

This month’s blog is a little bit of a departure from our usual style. While Lori has been swamped with client work this month, I started looking into trends in the senior housing industry.

For those of us who advise seniors and their families on transitions – there was an article in the news that caught our attention: “Welltower to buy Amica” from Ontario Teachers’ Pension Plan (“OTTP”). I first had a glimpse of this deal when visiting Aunt Peg. She lives in an Amica residence in Ontario. I noticed a flyer posted on the board in her dining room stating that Amica’s CEO was stepping down, and I remember musing to myself, why on earth do the residents need to know this and then within a few days the acquisition announcement was made. Ah. Changes ahead.

I get it, OTTP wanted their cash back after financing a management led privatization of Amica in 2015. Welltower is a US based real estate investment firm that has been acquiring the real estate assets of retirement residences all over North America. The deal was worth $4.6 billion. Welltower bought all 31 existing Amica residences in Ontario and BC, and they have an option to buy 7 properties currently in development. (Let me just say again, Welltower – specializing in privatized healthcare offerings – is a US company that now owns the retirement residences that your loved ones, and mine, live in. Ok moving on.)

This is not a new business strategy. Businesses sitting on real estate have tended to separate the management of the property and the owning of the property. Revera, another large owner of retirement residences has announced a similar strategy. Revera is now in the business of owning the properties, and they have farmed out the management of the homes to Cogir, a Montreal based management company.

And interestingly, Chartwell (yet another large owner of multiple retirement residences all over Canada) had a joint venture with Welltower since 2015. This was dissolved this year with the two entities splitting the properties. When searching for a “why” did they dissolve their joint venture, all I could find was “their evolving strategic priorities were differing”. Keep in mind this JV was less than 10 years old. Now that the properties have been split, Chartwell runs its homes as Chartwell, and Welltower, which retained 23 properties in the JV, has hired Cogir to manage their properties. Welltower, also took a minority interest stake in Cogir.

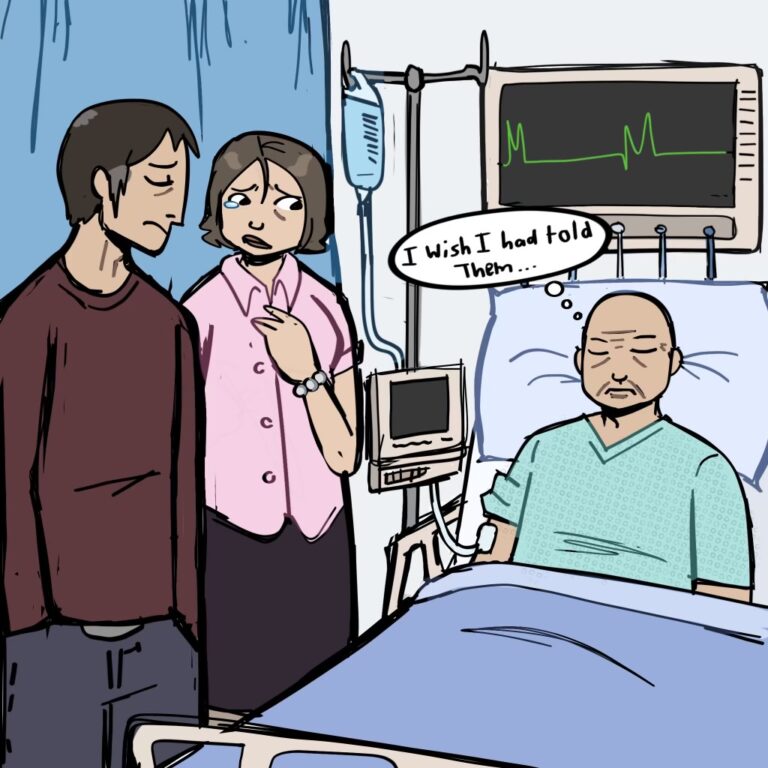

I am very curious as to what all this will mean for the seniors living in these residences, including Aunt Peg. Will the quality of food, services and care decrease in favour of a favourable return for investors? It looks like the owning of the real estate is the real prize for Welltower – however, the metric for success at Welltower is a term called “RevPOR” which means Revenue per occupied room; it is the same metric used by hotels.

How do you increase that Revenue? Charge higher rent. Charge higher prices for services, which in retirement homes, primarily means care. For those who don’t know, services in retirement homes is offered “a la carte” – housekeeping, accompaniment to and from dining, medication management, help with dressing etc. It is a bit self-serving to be the eyes and ears for the family regarding their loved ones, and they will tell you, with a slightly veiled warning, that perhaps your senior loved one needs more attention with dressing, cueing, moving, and because we want the best for them we will of course agree to more care….see where I am going with this?

Professor of health policy and equity at York University, Tamara Daly, was quoted as saying access to publicly funded care for seniors continues to be an issue. “They’re treated like tenants who live in apartment buildings who happen to be getting care, rather than people who have a variety of vulnerabilities who need a high level of care and support but who are unable to access it through our publicly funded system,” Daly said.

My cynical side is concerned that some businesses are profiting off the care that is needed for vulnerable seniors. On the other hand, will the freeing up of the “real estate investment” mean more attention to the actual management of the homes – better food, better amenities, more joy? I’ll have a front row seat to any changes as I visit with Aunt Peg.

I’ll keep you posted.